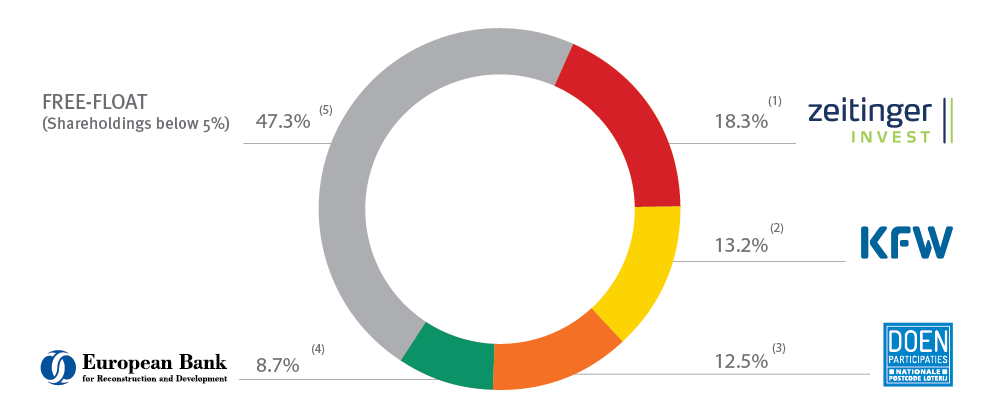

Acționariatul Grupului ProCredit

Grupul ProCredit este deținut de mai mulți acționari strategici și instituționali importanți. Principalii acționari ai ProCredit Holding AG includ:

- Zeitinger Invest GmbH – Unul dintre acționarii fondatori și un investitor strategic esențial.

- ProCredit Staff Invest GmbH & Co KG – Vehiculul de investiții pentru angajații ProCredit.

- Kreditanstalt für Wiederaufbau (KfW) – Banca de dezvoltare a guvernului german.

- DOEN Participaties BV – Investitor olandez axat pe proiecte de dezvoltare durabilă.

- European Bank for Reconstruction and Development (EBRD) – Instituție financiară internațională care a achiziționat recent acțiuni de la International Finance Corporation (IFC), devenind un acționar principal.

Acești acționari asigură un suport solid și diversificat pentru Grupul ProCredit, permițându-i să își îndeplinească misiunea de dezvoltare economică durabilă, cu un accent special pe sprijinirea întreprinderilor mici și mijlocii (IMM-uri) în Europa de Sud-Est și de Est, America de Sud și Germania.

Pentru mai multe informații, poți vizita pagina oficială a ProCredit Holding AG despre structura acționariatului.

1) Conform informațiilor raportate voluntar de Zeitinger Invest pe 13.04.2023 (vezi secțiunea „Alte informații” pe site-ul de relații cu investitorii al ProCredit Holding)

2) Conform informațiilor raportate voluntar de Kreditanstalt für Wiederaufbau (KfW) pe 17.04.2023 (vezi secțiunea „Alte informații” pe site-ul de relații cu investitorii al ProCredit Holding)

3) Conform informațiilor raportate voluntar de DOEN Participaties pe 14.04.2023 (vezi secțiunea „Alte informații” pe site-ul de relații cu investitorii al ProCredit Holding)

4) Conform notificărilor de drepturi de vot din 23.05.2023

5) Conform notificării privind drepturile de vot transmisă de TIAA Board of Governors la data de 24 iulie 2025, ponderea acțiunilor liber tranzacționabile (free float) a crescut la 47,3%.

Structura acționariatului prezentată mai sus se bazează pe notificările publice de drepturi de vot ale EBRD și TIAA, iar în cazul Zeitinger Invest GmbH, Kreditanstalt für Wiederaufbau (KfW) și DOEN Participaties B.V., pe divulgarea voluntară a drepturilor de vot (vezi „Notificări de drepturi de vot” și „Alte informații” în secțiunea de relații cu investitorii de pe site-ul ProCredit Holding). Această descompunere a fost calculată comparând numărul de drepturi de vot raportate de acționari la datele menționate mai sus cu numărul total de drepturi de vot (în prezent 58.898.492). ProCredit Holding AG a făcut eforturi rezonabile pentru a oferi o imagine realistă a structurii acționariatului. Cu toate acestea, din cauza limitărilor privind disponibilitatea și verificabilitatea datelor de bază, ProCredit Holding AG nu își asumă nicio responsabilitate pentru faptul că informațiile prezentate aici sunt exacte, complete și actualizate.