Programe de investiții și garanții oferite de UE

Descoperă programele de investiții și garanțiile oferite de Uniunea Europeană, special concepute pentru a sprijini companiile. Aceste inițiative facilitează accesul la finanțare, reduc riscurile asociate investițiilor și susțin dezvoltarea și inovația în afacerea ta.

Profită de aceste oportunități pentru a-ți crește competitivitatea și pentru a explora noi piețe, având alături un partener de încredere în drumul tău spre succes.

Planifică succesul afacerii tale cu InvestEU

Acordul semnat între ProCredit Bank și FEI reprezintă un pas important în sprijinirea eforturilor noastre de a oferi finanțare avantajoasă întreprinderilor mici și mijlocii din România, prin garantarea până la 70% din valoarea finanțărilor (50% pentru București și 70% pentru restul județelor).

Cu sprijinul Programului InvestEU, ProCredit Bank oferă finanțări clienților săi pentru susținerea investițiilor verzi, de la energie regenerabilă și eficiență energetică până la mobilitate și agricultură, precum și pentru acoperirea nevoilor de capital de lucru necesare IMM-urilor din România.

Beneficiile clienților ProCredit Bank:

- Finanțare avantajoasă în LEI și EURO

- Garanție de până la 70%, fără costuri suplimentare pentru client, susținută de Fondul European de Investiții

- Credite pentru investiții și/sau capital de lucru

- Avans zero

- Maturitate credite pentru capital de lucru: până la 3 ani

- Maturitate extinsă pentru investiții: pana la 15 ani

- Plan de rambursare personalizat în funcție de modelul de business

Destinații eligibile prin InvestEU

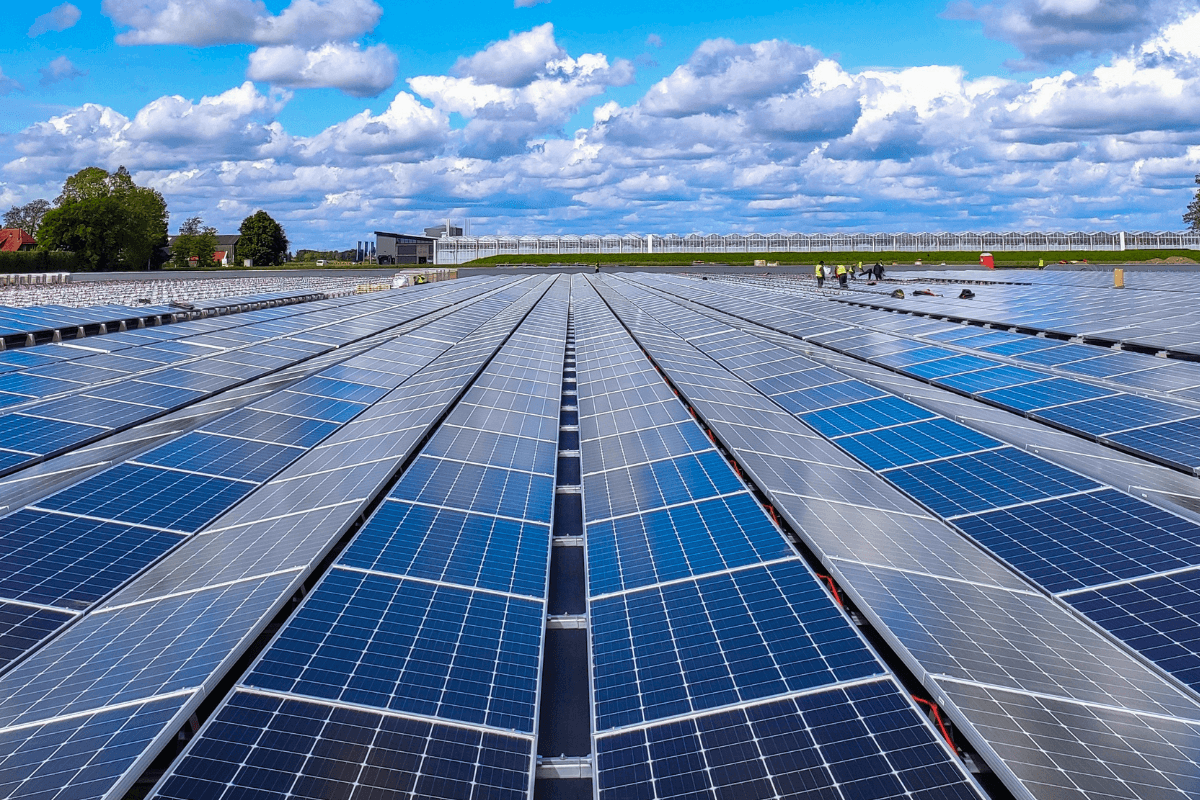

Finanțare pentru panouri fotovoltaice

Achiziție terenuri agricole și spații de depozitare

Investiții în echipamente noi și eficiente energetic

Credite pentru capital de lucru

Parteneriat cu Fondul European pentru sud-estul Europei

Parteneriatul dintre ProCredit Bank și EFSE oferă soluții de finanțare avantajoase pentru clienți din toate sectoarele de activitate. Fondul European pentru Sud-Estul Europei (EFSE) sprijină prin fonduri dedicate practicile agricole durabile în Europa, promovând astfel dezvoltarea economică și protejarea mediului înconjurător. Acest parteneriat facilitează accesul la resurse financiare necesare pentru inovație și creștere în diverse industrii, inclusiv agricultură, industrie și servicii.

Răspundem celor mai frecvente întrebări

Ce fel de investiții pot fi realizate prin InvestEU?

Companiile beneficiază de finanțare pentru realizarea de investiții diverse precum modernizare, echipamente eficiente energetic, mașini și ehipamente electrice. Afacerile interesate de reducerea costurilor cu energia electrică prin investiții în panouri fotovoltaice pot pentru realizarea întregului proiect.

În plus, ProCredit Bank prioritizează finanțarea acestor investiții și oferă suport dedicat clienților.

InvestEU se adresează și agricultorilor?

InvestEU se adresează și fermierilor, iar ProCredit Bank oferă suport agricultorilor din România de peste 20 de ani.

Susținem fermierii prin facilitarea accesului la creditare pentru terenuri agricole, silozuri, echipamente pentru agricultura conservativă și digitalizare.

În plus, prin InvestEU se pot acorda credite de capital de lucru, fără a mai fi nevoie de garanții solide.

Cum aplic pentru finanțare la ProCredit Bank?

1. Completează formularul de contact și discută cu un reprezentant

Completează formularul de aici, iar un consilier te va contacta pentru a discuta mai multe despre planurile tale de viitor. Programul InvestEU presupune o serie de condiții de eligibilitate, însă vei primi consultanța necesară pentru găsi soluția de finanțare potrivită.

2. Deschizi un cont 100% online și transmiți documentele de analiză

Îți poți deschide deja un cont de persoana juridică 100% online chiar de aici. Odată ce ai devenit client, consilierul tău dedicat îți va solicita toate documentele necesare pentru începerea analizei de credit.

3. Semnezi digital contractele, fără să mai vii la bancă

Dacă totul este în regulă în urma analizei, semnezi contractele de oriunde ai fi. La ProCredit Bank beneficiezi de semnătură digitală în relație cu banca.

De ce să alegi ProCredit Bank?

ProCredit Bank este alături de tine și de afacerea ta!

Pe lângă beneficiile oferite de abordarea 360 în ceea ce privește creditarea, te bucuri de:

- Deschidere de cont 100% online

- Autorizarea persoanelor pe contul de Business 100% online

- Obținerea unei Scrisori de Garantie Bancară în 24 de ore

- Consilier de Business dedicat

- Consultanță completă pentru accesarea finanțării potrivite

- Răspuns rapid

- Abordare personalizată

- Aprobarea unei limite de finanțare, tip umbrelă, valabilă 12 luni

Aplică aici și obține finanțare pentru următorul tău proiect.

Finanțare cu Programe Naționale

Programul INVESTALIM

Programul, gestionat de MADR, oferă surse nerambursabile. Pentru a primi ajutor de stat, societatea solicitantă trebuie să obțină un acord de finanțare de la AFIR.

Programul IMM PLUS

Suntem parteneri de încredere alături de fondurile naționale FNGCIMM, FGCR și FRC în cadrul programului IMM PLUS și a componentelor sale.

PNRR

Obiectivul principal al PNRR este dezvoltarea României prin programe și proiecte care sprijină reziliența, pregătirea pentru crize, adaptabilitatea și creșterea, folosind fondurile alocate prin mecanism.