București, 17 noiembrie: ProCredit Bank România a finalizat cu succes acordarea finanțării în valoare de 3,15 milioane de Euro Grupului nextE, în cadrul unui proiect inovator pe piața de energie regenerabilă. Odată cu finalizarea acestui acord, ProCredit Bank inițiază finanțarea proiectelor de tipul EaaS (Energy as a Service) de o importanță deosebită pentru mediul de business din România. Acest proiect are agreat un PPA (Power Purchase Agreement) pe 25 de ani, de tipul corporate onsite, conform contractului pe care nextE îl are deja semnat cu RAAL.

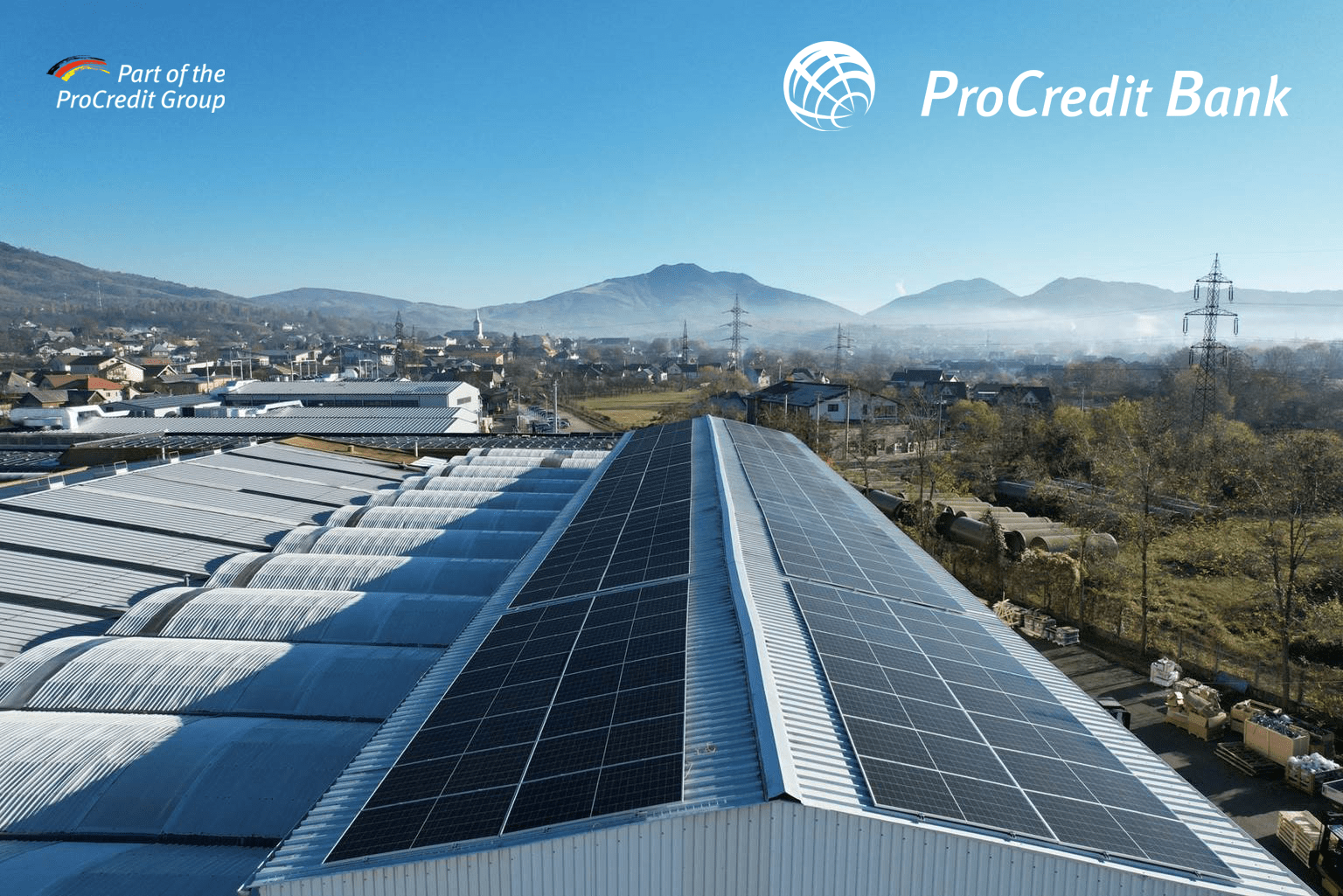

Finanțarea a fost acordată pentru construirea unei centrale fotovoltaice cu o putere instalată de 7.4 MWp în județul Bistrița Năsăud. Construcția s-a realizat pe proprietatea unei facilități de producție, care este și principal consumator de energie electrică în cadrul proiectului.

“Finanțarea nextE este încă o dovadă a angajamentului nostru față de IMM-urile care investesc în energie regenerabilă. Sprijinul ProCredit se îndreaptă atât spre prosumatorii sau producătorii de energie electrică, cât și spre cei care implementează soluții inovative, complete și particularizate, precum mecanismul Energy as a Service (EaaS). De asemenea, pe lângă faptul că acest mecanism aduce cu sine avantajul de a livra direct energia electrică generată către utilizatorul final, el oferă IMM-urilor nu doar independență energetică, ci contribuie și la scăderea emisiilor de dioxid de carbon.“ declară Ștefan Manole, Director General ProCredit Bank România.

”Suntem încântați de colaborarea noastră cu ProCredit Bank și de modul în care acest parteneriat a evoluat într-un timp atât de scurt. Flexibilitatea și rapiditatea cu care au gestionat acest acord de împrumut pentru investiții verzi ne-au depășit așteptările și ne-au oferit o platformă solidă pentru extinderea proiectelor noastre” a adăugat Nicolas Pleșea, Director Financiar nextE Holding/Renewable.

Parteneriatul între ProCredit Bank și nextE reprezintă un pas important în implementarea unei agende energetice mai durabile la nivel național. Acest lucru, permite Grupului nextE să finanțeze proiecte cu până la 70% din datorie, facilitând astfel extinderea capacității fotovoltaice în țară.

Proiectul centralei fotovoltaice de la Bistrița-Năsăud, amplasată pe proprietatea unei facilități de producție, va opera pe modelul de închiriere și operare (rent and operate). Din producția de energie generată, estimată la 7200 MWh/an, și luând în considerare profilul de consum al fabricii, aproximativ 80% din energia produsă va fi furnizată pentru consumul intern, în timp ce surplusul de energie va fi injectat în rețeaua națională. Un aspect aparte în cadrul proiectului îl reprezintă amplasarea panourilor fotovoltaice, astfel că, o parte au fost instalate pe acoperișul clădirii, iar restul la sol, pentru utilizarea cât mai eficientă a spațiului disponibil. Echipamentul instalat provine de la producători Tier 1, renumiți pentru fiabilitatea lor.

nextE este o companie care funcționează în regim de Producător Independent de Energie (IPP), iar în prezent se concentrează pe dezvoltarea operațiunilor prin mecanismul Energy as a Service (EaaS). Această abordare oferă companiilor consumatoare independență energetică și stabilitate pe termen lung, fără suportarea costurilor inițiale aferente investiției, a riscurilor de performanță și operaționale, dar, mai ales, reduce costurile cu energia electrică și amprenta de CO2.

ProCredit Bank România

ProCredit Bank România este parte a grupului ProCredit, orientat spre dezvoltare, care este format din bănci comerciale pentru întreprinderi mici și mijlocii (IMM-uri). ProCredit Holding AG, cu sediul în Frankfurt am Main, Germania, este compania-mamă a grupului ProCredit. Pe lângă concentrarea sa operațională asupra Europei de Sud-Est și de Est, grupul ProCredit este, de asemenea, activ în America de Sud și în Germania. Acțiunile companiei sunt tranzacționate pe segmentul Prime Standard al Bursei de Valori din Frankfurt. Acționarii principali ai ProCredit Holding AG includ investitorii strategici Zeitinger Invest și ProCredit Staff Invest (vehiculul de investiții pentru personalul ProCredit), KfW, societatea olandeză DOEN Participaties BV și, recent, Banca Europeană pentru Reconstrucție și Dezvoltare. În calitate de companie mama a grupului, conform Legii bancare germane, ProCredit Holding AG este supravegheată la nivel consolidat de Autoritatea de Supraveghere Financiară Federală Germană (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) și de Bundesbank din Germania.